You’ve been paying into the Social Security system for decades, now it’s time to decide when to start receiving your hard-earned benefits.

The Basics: When Can You Claim?

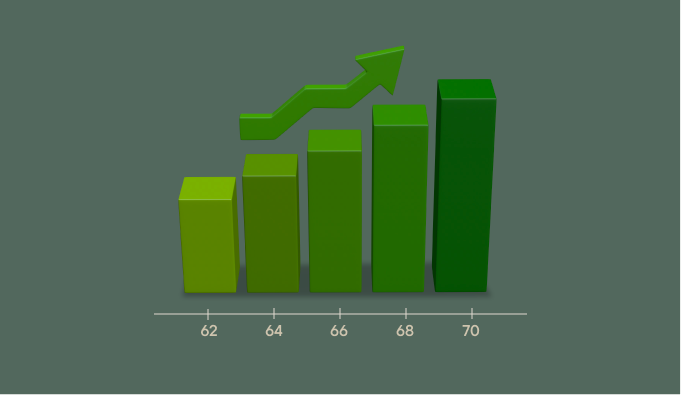

You can begin claiming Social Security benefits as early as age 62, but doing so permanently reduces your benefit by 30%. You see lesser reductions each year as you approach your full retirement age (FRA).

Waiting, on the other hand, pays off. Delaying benefits past FRA increases your benefit by 8% per year until age 70.

For example, if your FRA age is 67 and benefit is $3,500 per month, claiming at 62 would lower it to $2,450 while waiting until 70 would grow the benefit to around $4,400.

The Right Time for You

Your optimal timing really depends on several factors, including cash flow needs, health, marital status, and ongoing employment.

One helpful strategy we use with our clients is calculating breakeven age. Think of your breakeven age as the point where the higher checks from waiting finally catch up to what you would’ve received by starting early. For most people, this is around age 80 to 82. If you expect to live beyond that, waiting may result in greater lifetime income. But if you have health concerns or need the income sooner, taking benefits earlier can make sense.

Married? Coordination Is Key

Social Security decisions are even more nuanced for married couples.

Each spouse can claim based on their own work record or 50% of their spouse’s full retirement age benefit, whichever is higher. If one spouse passes away, the surviving spouse receives the higher of the two benefits.

Because of this, coordinating your claiming strategy matters. Often, the lower-earning spouse may claim earlier, while the higher-earning spouse delays to maximize the survivor benefit. The goal is to optimize not just monthly cash flow now, but long-term household income.

The Bottom Line

There’s no one-size-fits-all answer to when you should start Social Security. At JGP Wealth Management, we help our clients make this decision strategically and intentionally.