Financial planning can seem like a scary, overwhelming task. It’s not something anyone ever taught you how to do in school, and given that only 33% of Americans have a written financial plan, you may not know anyone who has a financial plan either. That makes it easy to put off—or avoid entirely.

But you don’t have to be scared of financial planning or unsure about where to start. At JGP Wealth Management, we think everyone should have a written financial plan, and we’re eager to help teach people what to do. To help, we’ve put together this guide on four ways couples in their 30s and 40s can start their financial plan. If you tackle each of these items one by one, you won’t feel as overwhelmed with your finances and will experience more confidence in your financial future.

1. Set Clear Goals

Setting goals is the first step to making your financial plan a reality. By setting goals, you can gain clarity on where you want to go, which will then help you determine what steps are needed to get there.

For example, if you and your spouse have never discussed when you want to retire, or the kind of lifestyle you want in retirement, you’ll be left directionless on what you need to do with your retirement savings. But if you decide you want to retire at 55 with $20,000/month of income, now you have clarity on exactly what you want, and can find out how much you need to save per month so you can reach that goal.

But don’t let retirement be your only goal. You might also want to save for your children’s college, buy a house (or a second house), transition to self-employment, or a number of other great goals to pursue. Whatever your goals, getting crystal clear on identifying them, and the financial numbers involved, will be the basis of your financial plan.

2. Determine Where to Save

Now that you have your financial goals set out clearly, you’ll want to determine the best way to save and invest that money to reach those goals. This is one mistake I often see people in their 30s and 40s make; they are DIYing their finances, and as a result, aren’t optimally using each of the accounts they have access to.

If your goal is to maximize retirement contributions, it might make sense to take full advantage of your employer-sponsored retirement account, since you can contribute up to $22,500 in a 401(k) in 2023. Yet if your goal is to build up a solid down payment for a home, it may not make as much sense to tie up your money in retirement accounts, and you should save that money elsewhere.

The exact answer depends on your goals as well as your current financial situation. Working with a financial planner who understands what you’re working toward, and can help you understand the pros and cons of contributing to each type of financial account, is essential to choose the right places to save your money.

3. Get the Right Risk Tolerance

Understanding your risk tolerance is an essential part of investing. What is it exactly? Risk tolerance is a measure of how much market volatility (the ups and downs of the stock market) you are comfortable with and how much risk you are willing to take on when investing.

As with everything in your financial plan, knowing your goals will be an important piece of the puzzle. If you are in your 30s and hope to retire in your late 50s or 60s, you might have a higher risk tolerance with your investments. Yet if you are trying to save up for your kids’ college education in 5 or 10 years, given the shorter time horizon, you might prefer to have a more conservative investment allocation.

Understanding your risk tolerance can help you avoid making decisions that are too aggressive or conservative for your investment goals. Being aware of your risk tolerance allows you to make informed decisions about which investments best suit your needs.

4. Understand Your Options and Maximize Your Opportunities

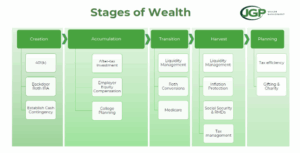

As a young professional, you likely have access to a number of investment options. While you may not take advantage of them all at a given period of time, it’s wise to know what your options are and the benefits to each. To help clarify this consuming topic, we’ve created this graph showing some of the best options available to create and accumulate wealth:

As you can see in the “Creation” and “Accumulation” stage, there are at least six different ways to grow your wealth, and each have their place in your overall financial plan.

Of particular importance in my mind is to take full advantage of the benefits your employer offers. It could be through a 401(k) or health savings account matching program, employer equity in the form of stock options, or something else entirely. Regardless of the type, approximately 30% of an employee’s compensation comes in the form of benefits, so we want to make sure you’re maximizing those to the fullest extent.

Putting it All Together

Don’t be afraid or overwhelmed to get started with your financial plan. If you’re unsure of where you currently stand, or wish you could be in a better position, the most important thing is to take that first step in your financial planning journey. If you’d like help creating your plan and navigating these decisions, I’d love to help. To get started, you can reach out to me at [email protected] or 503-446-6450.